Mega Cap Dominance Masks Growing Market Fragility

Equity markets pushed to fresh highs in the second quarter, but beneath the surface, leadership continued to narrow dramatically. A small group of mega cap technology stocks once again drove index-level returns, while most of the market struggled to keep pace. As market concentration reaches historic extremes, investors are increasingly forced to confront an important question: how sustainable is this leadership?

Mega Cap Tech Did the Heavy Lifting — Again

For another quarter, a handful of mega cap technology stocks were responsible for the majority of equity market gains. Nvidia alone accounted for nearly half of the S&P 500’s total return in 2Q, while the “Magnificent 7” collectively delivered more than 100% of the index’s performance, masking weakness across the rest of the market

Investor preference gravitated toward the perceived safety and earnings durability of mega cap technology, while risk appetite faded elsewhere. Small caps, high-beta stocks, and other speculative assets rolled over as capital concentrated further at the top of the market.

Market Returns Diverged Sharply in 2Q

Source: FactSet as of 7/9/2024

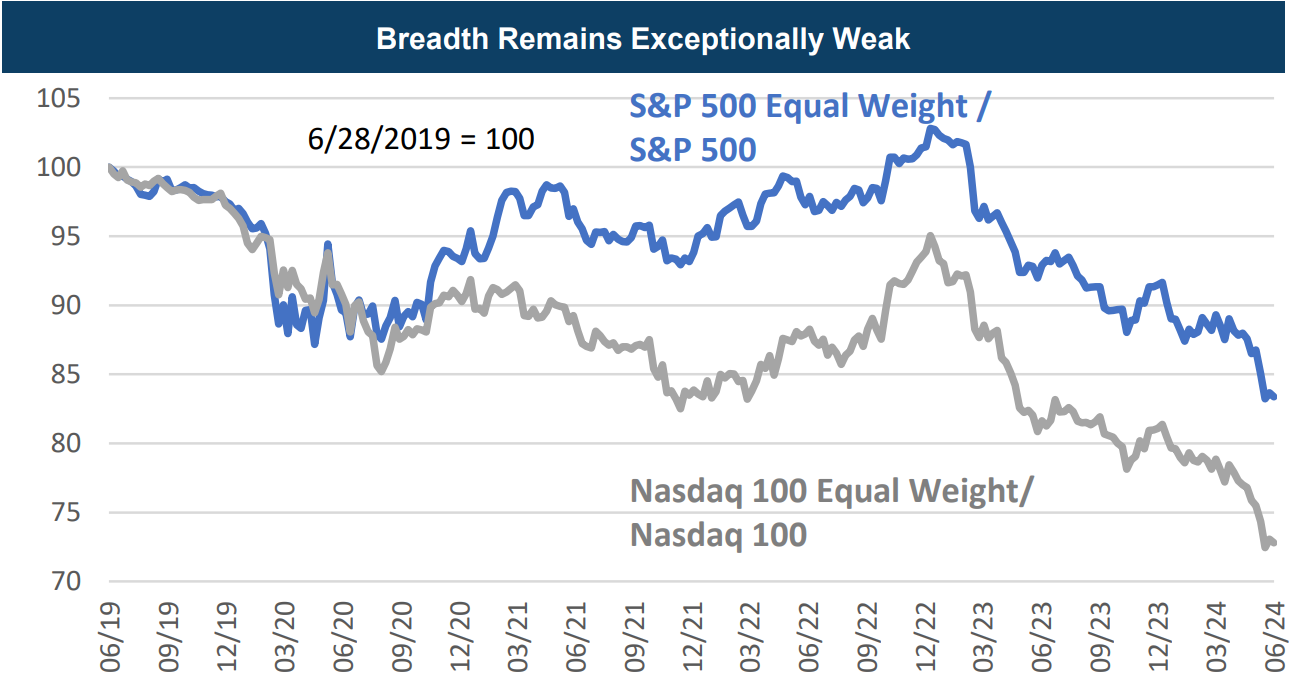

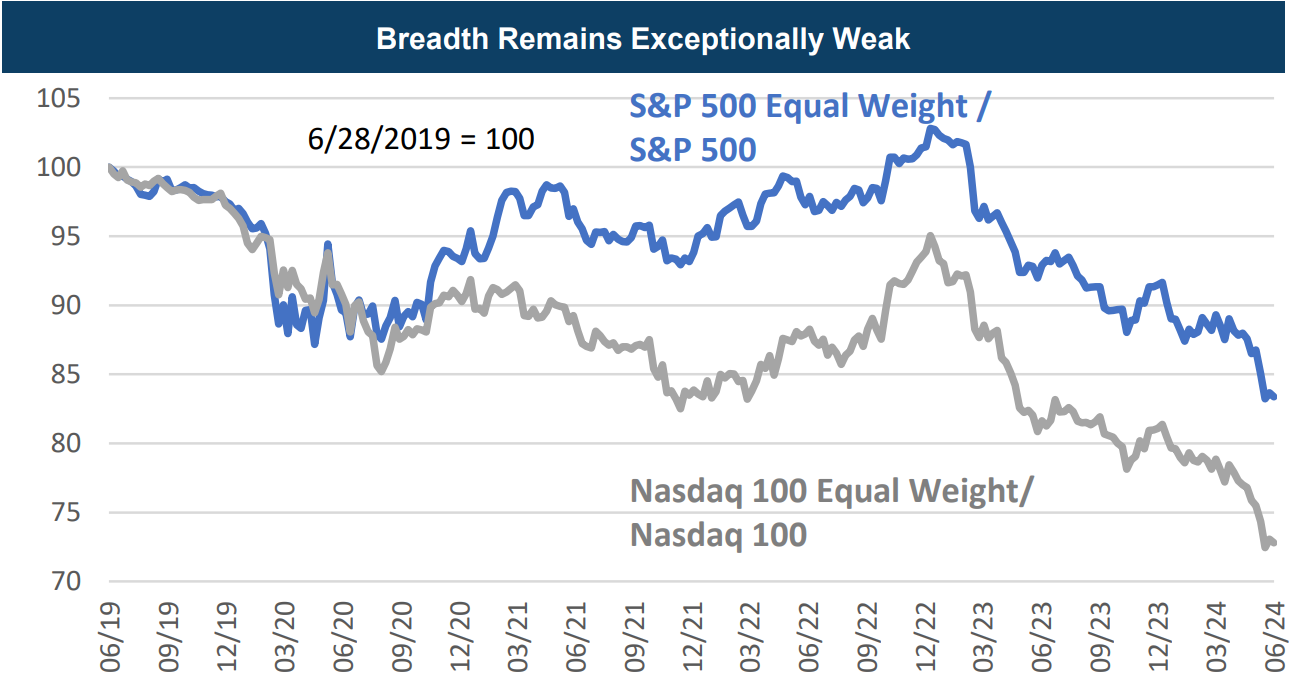

Market Breadth Hits Record Lows

The degree of market narrowing reached levels rarely seen historically. Equal-weight indices lagged their cap-weighted counterparts by a wide margin, reflecting exceptionally weak breadth across both large cap and growth-oriented benchmarks

Historically, periods of extreme cap-weighted outperformance have tended to be mean-reverting. While narrow leadership can persist longer than expected, the odds of broader participation improving over time increase as concentration reaches these levels.

Who Is Left to Buy?

Another challenge facing mega cap leadership is positioning. Most long-only large cap managers already own — and are overweight — the Magnificent 7. Incremental demand is increasingly driven by passive flows, which mechanically allocate more capital to these stocks as their index weights grow. As ownership becomes more saturated, the hurdle for continued outperformance rises.

The Fed’s Delicate Balancing Act

Markets continue to price in a near-perfect outcome for monetary policy — a scenario where inflation cools without meaningful economic disruption. While inflation has moderated, it remains sticky enough to limit the Federal Reserve’s flexibility. At the same time, labor market data is beginning to soften, with unemployment now meaningfully above its cycle trough

If the Fed errs, the risk is that policy easing comes too late, after a growth slowdown has already taken hold.

Market Breadth and Mean Reversion Signals

Source: Westfield, FactSet, as of 6/30/24

Valuations Are Stretched — But Opportunities Remain

Large cap valuations now sit near the upper end of historical ranges, regardless of metric. However, valuation dispersion across sectors and market capitalizations remains wide. Small caps continue to trade at a significant discount to large caps, and several cyclical and defensive areas of the market offer more compelling risk-reward profiles for active investors

Looking Ahead

While equity momentum remains strong, the combination of elevated valuations, extreme concentration, and slowing economic data suggests a more balanced and selective approach may be warranted. Periods like these often reward disciplined active management, particularly as leadership broadens and relative opportunities emerge beyond the largest stocks.