Insights

|

Health Care: From Sector Laggard to Long-Term Leader

We believe Health Care currently offers some of the most attractive secular growth opportunities in U.S. equities, particularly given low absolute and relative valuations.

Read Article

On our 3Q webcast, we highlighted several areas that made the market feel increasingly vulnerable — narrow leadership, heavy retail participation, and speculative pockets that had gone parabolic. Over the past few weeks, many of the issues that we discussed have begun to surface. We were cautious on the market then and continue to be now.

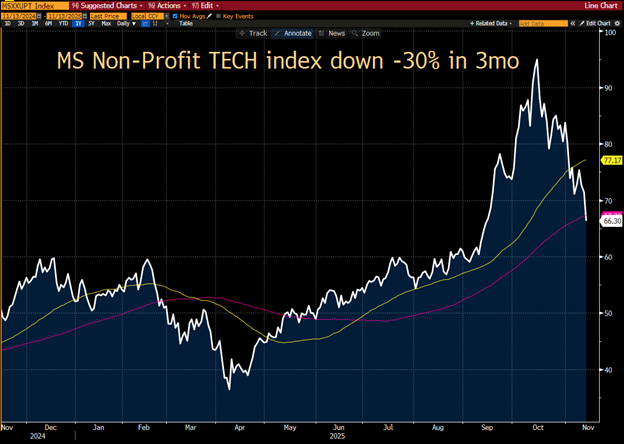

Several speculative areas we highlighted have come under meaningful pressure. Bitcoin sliced through 90k decisively, the non-profitable tech index is down roughly 30% in three months, and retail favorites — meme, nuclear, uranium, quantum, space — all reversed sharply. The momentum unwind across AI-adjacent and high-beta areas is consistent with the vulnerable setup we walked through in October. Having a long history and knowledge of markets allowed us to not overreact to momentum and retail favorites during that period, and instead reinforce our commitment to quality growth and free cash flow.

Chart 1: Non-Profitable Tech Index — 30% decline over 3 months

Source: Farzin Azarm, Mizuho Americas, as of 11/13/2025

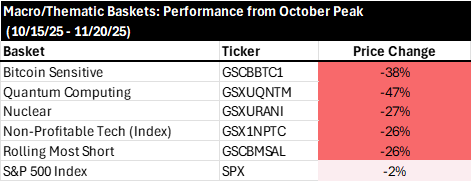

The thematic baskets that led the speculative surge earlier this year were also among the weakest performers recently:

Chart 2: High-flying pockets have finally blinked

Source: Bloomberg as of 11/20/2025

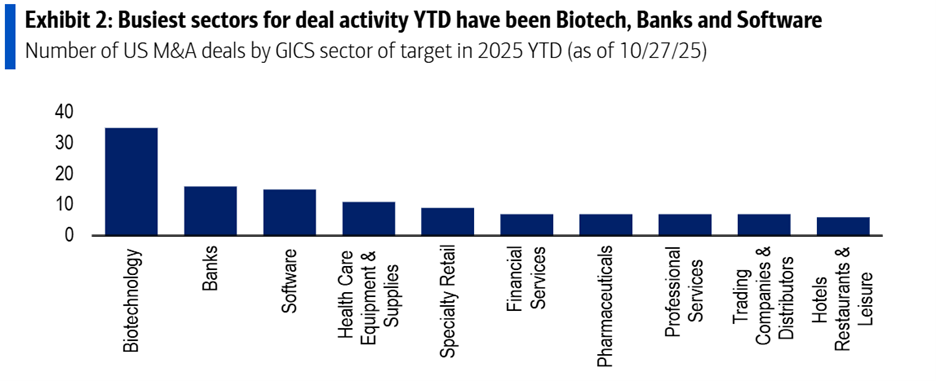

At the same time, we’ve seen an uptick in M&A — particularly in Health Care and biotech — which aligns with the conditions we discussed on the call, given depressed valuations, improving revisions, and major patent-expiration clusters across large pharma.

Chart 3: Health Care has dominated deal activity YTD, most notably in Biotech.

Source: BofA US Equity Quant Strategy as of 11/7/25

We’ve also seen rotation toward laggards and higher-quality areas — Health Care, Financials, and select Industrials — a shift that often follows periods of speculative excess.

A lot of this reflects the underlying conditions we discussed in Q3. Multiple expansion had effectively run its course. Retail leverage left limited cushion once momentum turned. Retail poured money into thematic and leveraged ETF’s right at the top. Early credit stress — most notably the widening in CDS spreads — signaled that not all was well beneath the surface. And across AI, the capital intensity, debt-funded capex, and circular financing loops pushed expectations well ahead of fundamentals.

Looking ahead, the setup remains more uncertain than usual. A traditional year-end rally isn’t guaranteed, and we do not expect Fed cuts in December or early 2026. From here, returns will need to come from earnings, not higher multiples — which is why we continue to emphasize quality and laggards with durable balance sheets and improving earnings trajectories: Health Care (our highest-conviction area), Financials, and select Industrial and Consumer names.

Many of the dynamics we were watching in Q3 have begun to play out. We remain constructive but cautious — focusing on fundamentals, and positioning portfolios for a more selective, earnings-driven market as we move toward 2026.

Best,

Will

Will Muggia

President, CEO & CIO

Important Disclosures

The views expressed are those of Westfield Capital Management Company, L.P. as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable.

Past performance is not indicative of future results.

Some of the content on the preceding pages has been supplied by companies that are not affiliated with Westfield (“third party data”). Any third-party data contained herein has been obtained from sources believed to be reliable, but the accuracy of the information cannot be guaranteed.

These materials are being provided on the basis that they and any related communications will not cause Westfield to become an investment advice fiduciary under ERISA or the Internal Revenue Code with respect to any retirement plan or IRA investor, as the recipients are fully aware that Westfield (i) is not undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity, and (ii) has a financial interest in the offering and sale of one or more products and services, which may depend on a number of factors relating to Westfield’s internal business objectives, and which has been disclosed to the recipient.

We believe Health Care currently offers some of the most attractive secular growth opportunities in U.S. equities, particularly given low absolute and relative valuations.

After years of lagging, small caps may finally be positioned for a turn. Valuations are at generational lows, earnings have turned positive, and expected rate cuts could provide an outsized tailwind. With market concentration at extremes, even modest rotation could drive powerful catch-up for small caps, Healthcare, and Cyclicals. We believe the risk today is tilted more toward being too bearish than too bullish.

The S&P 500 has erased all post-election gains, shedding $3.4T in value. Weak breadth, inflation, and policy risk are weighing on sentiment—yet a capitulation phase has yet to hit. Read our full take on what’s next.

Subscribe to Westfield Insights.

*Indicates required field

By subscribing you agree to our Privacy Policy and electronic marketing communications.